Blog Details

How to Succeed With AI: 4 Proven Tips for Today’s Insurance Leaders

The insurance world is rewriting its rules. Distribution models, customer engagement, underwriting, and claims are all being reshaped by artificial intelligence. In 2025, embracing AI isn’t just about investing in tools; it’s about adopting a leadership mindset that blends compliance, innovation, and operational intelligence. Everinley supports insurance decision-makers with modern AI strategies, compliance roadmaps, and insurance productivity solutions that deliver measurable outcomes.

If you're an insurance executive, broker-channel director, or COO guiding digital transformation, these 4 practical tips will help you scale AI confidently and strategically.

Tip 1: Define Success Before Deploying AI

AI works best when the end goal is clear. Many insurance organizations fail to see long-term results because they implement technology first and strategy later. Successful leaders reverse this process.

AI initiatives should start by identifying real operational pain points, such as:

-

Slow policy issuance and documentation turnarounds

-

Overloaded CRM systems, inconsistent updates, and poor lead tracking

-

Long claim cycle times are impacting customer satisfaction

-

Fraud leakages from fake liability or property claims

-

Disorganized agency back-office processes

Setting KPIs early allows you to measure insurance underwriting improvements, sales acceleration, claim speed, and cost-saving efficiency powered by AI.

With direction-first implementation, AI becomes an investment, not an experiment.

Tip 2: Strengthen Compliance Using Smart Digital Tools

2025 introduces a more structured insurance regulatory landscape 2025, pushing compliance to the center of AI adoption.

Insurance leaders must navigate:

-

Data privacy mandates set by the National Association of Insurance Commissioners frameworks

-

Consumer protection expectations from European-style privacy rules, like GDPR alignment principles

-

Local regulatory pressures demanding fairness, audit trails, and explainability in underwriting and claims

-

Expectation for transparent AI recommendations at the point of insurance sales

Using modern insurance compliance technology, leaders can monitor regulation shifts, track algorithmic changes, validate data inputs, and ensure:

-

Unbiased AI underwriting results

-

Secure consumer data usage

-

Documented audit trails of automated offers and claims

-

Ethical decision-making standards

Everinley offers compliance-support automation that helps insurers stay protected while scaling AI adoption.

Tip 3: Upskill People, Not Just Platforms

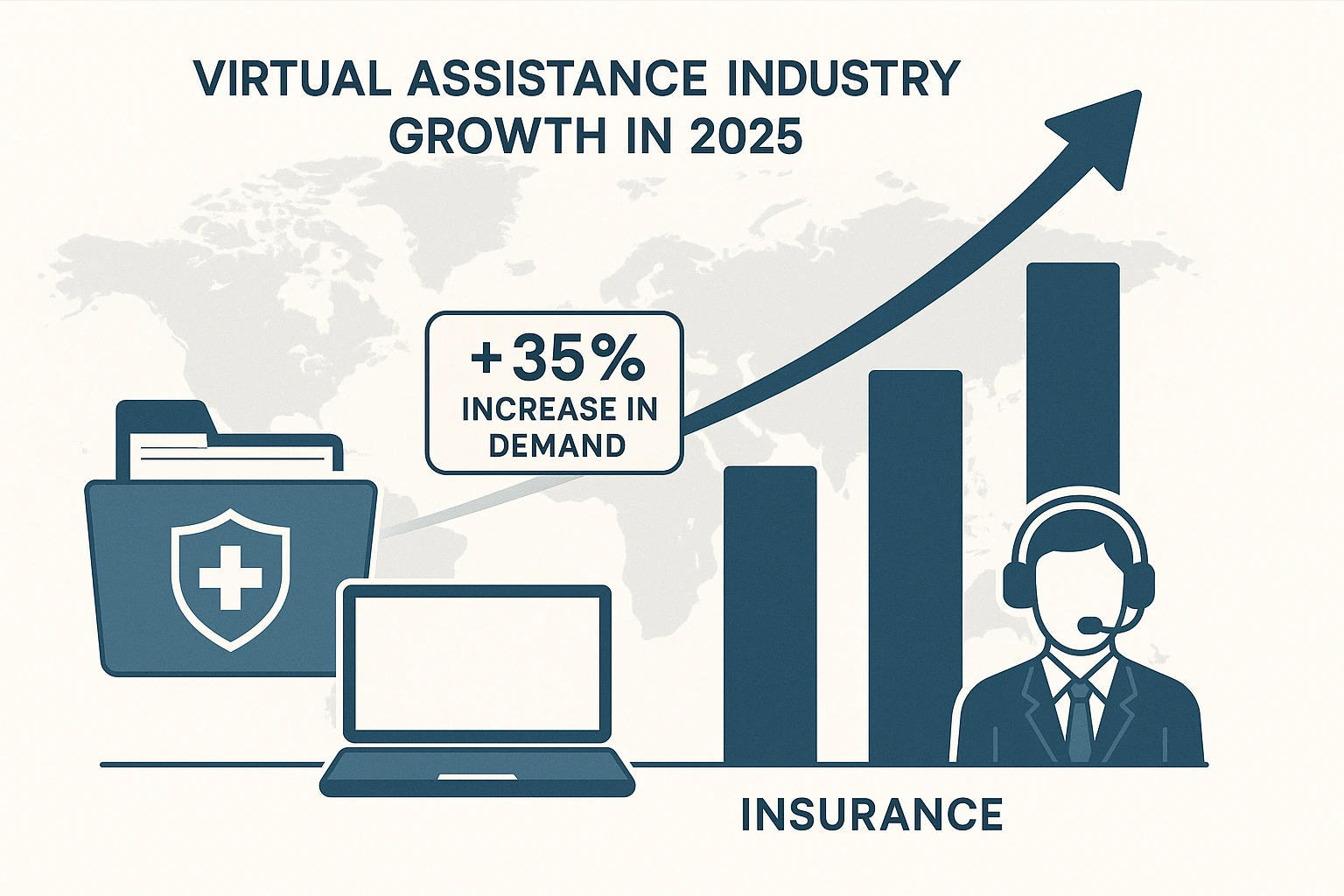

Digital transformation succeeds when technology and talent move forward together. A virtual assistant for insurance brokers ensures daily administration, CRM updates, data entry, policy documentation, customer support, lead follow-ups, and renewals happen without delays.

Organizations that invest in AI readiness prioritize:

-

Team familiarity with workflow automation tools

-

Adoption of AI + VA systems for back-office support

-

Client engagement handled by trained VAs

-

CRM infrastructure, scaled using platforms like Salesforce, supports standards

With structured outsourcing, insurers can close more insurance deals with intelligent virtual assistants, ensure compliance needs are met, and automate routine workloads to increase overall agency revenue capacity.

Tip 4: Use AI to Enhance Human Judgment, Not Replace It

AI doesn’t have to compete with human expertise; it should multiply it. The most successful insurance leaders use AI to:

-

Score risk intelligently using AI-based scoring models

-

Assign claim priority using intelligent claims triage systems

-

Detect fraud patterns with machine learning in insurance fraud detection

-

Streamline workflows using insurance claims workflow automation tools

-

Reduce processing delays by reducing claim cycle time with AI

Critical decisions like complex legal claims, negotiated settlements, underwriting exceptions, or high value assets still benefit from human review, but AI helps route, evaluate, score, and recommend quickly.

This combined model builds faster, smarter insurers, stronger customer trust, fewer fraud leakages, and greater scalability.

Future of Insurance Regulation and AI

Everinley delivers:

-

AI insurance claims management enhancements

-

Automated fraud detection software support

-

Insurance CRM management support and lead follow-up automation

-

AI innovations for insurance distributors and brokers

-

Remote VA-driven operations that streamline insurance agency operations

AI-first disruption requires a human-backed strategy. Everinley gives you both.